STEP 1: UNDERSTANDING GOLD TRADING AND INVESTING

STEP 2: UNDERSTANDING PRICE DRIVERS FOR GOLD

To trade gold successfully, it’s important to grasp the factors that influence its price movements. Some major drivers include:

Mining

Gold mining affects the supply of new gold in the market. Although gold can be recycled, it remains a finite resource, and mining activity has slowed down globally. As demand increases and mining reserves dwindle, prices are likely to rise.

Demand

Gold demand has consistently increased over the years, driven primarily by jewellery consumption and gold ETFs. As supply declines, demand becomes a critical factor impacting gold prices.

Global Currencies

Gold often exhibits an inverse relationship with major world currencies, such as the US dollar, Japanese yen, or British pound. When gold rallies against these currencies, it is considered an opportune time to buy gold.

Interest Rates

Interest rate fluctuations affect gold prices. Rising interest rates tend to lower gold’s value as investors shift towards fixed-income assets. Conversely, declining interest rates drive investors back to the perceived security of gold.

Political, Economic, and Security Issues

Gold is considered a safe haven investment during times of market volatility, political instability, financial stress, or global events like the COVID-19 pandemic. These factors can cause significant spikes in gold prices. On the other hand, periods of economic prosperity and positive financial markets may reduce the demand for gold in favour of other assets.

STEP 4: OPENING YOUR GOLD TRADING OR INVESTMENT ACCOUNT

After practicing with a risk-free demo account, you can start trading in live markets by creating a live Forex account. Setting up an account with VT Markets is a straightforward process, taking just a few minutes, even for beginners.

STEP 5: IDENTIFYING TRADING OPPORTUNITIES

With your trading or investment account, you’ll have access to various tools, technologies, and market analysis. Platforms like MetaTrader 4 and MetaTrader 5 offer features to help you identify the right opportunity for trading gold based on technical indicators and market trends.

STEP 6: EXECUTING YOUR FIRST GOLD TRADE OR INVESTMENT

When opening a gold trade, it’s essential to manage risk and avoid overexposure. Implement tools like stop-loss orders or limit-close orders to automatically close your trade when it reaches a predetermined threshold. Depending on your strategy and outlook, choose between spot trading, gold futures, gold options, gold ETFs, or gold stocks.

STEP 7: DEVELOPING YOUR STRATEGY AND CLOSING YOUR POSITION

Monitor your trade’s profit or loss position using the trading platform’s powerful tools. Stay informed about broader market trends and make informed decisions to close your position at an advantageous point according to your investment and trading strategy.

READY TO START TRADING GOLD?

If you’re ready to embark on your gold trading journey, VT Markets is an ideal platform offering exceptional customer service and an intuitive trading platform accessible from your computer or mobile device. Whether you want to learn how to trade gold, access market analysis, or receive Forex signals, VT Markets simplifies the process of market trading. Create your gold trading account today or contact us for further information about our trading tools.

SUMMARY:

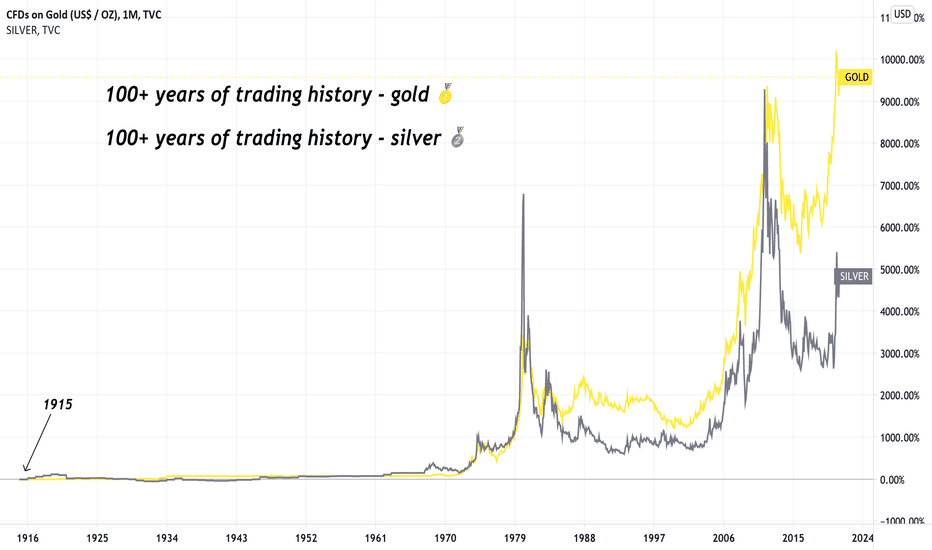

- Gold trading and investing have become attractive options for investors due to the stable value of gold, especially during times of economic uncertainty.

- Understanding the different types of gold assets is crucial before trading gold, including physical gold, spot price purchasing, gold futures, gold options, gold ETFs, and gold stocks.

- Factors that influence gold prices include mining activity, demand for gold, global currencies, interest rates, and political, economic, and security issues.

- The choice of trading or investment approach depends on investment goals and risk tolerance, with spot trading, gold futures, and gold options suitable for active traders, while gold ETFs and gold stocks are better for long-term gains and portfolio diversification.

- Developing a strategy and monitoring market trends are important for making informed decisions and closing positions at advantageous points according to the investment and trading strategy.

Start your trading journey.

3 easy steps to start your path to trading success